Looking Back: On Unga Group

Looking Back is a series of blog posts dedicated to looking back on the last 10 years in the Nairobi Stock Exchange. Peter has been analyzing the performance of these stocks on his Twitter timeline and has graciously allowed us to convert his tweets into posts for your reading.

Looking back, if you invested KES 100,000 in Unga Limited’s stock ten years ago, you would today be holding stock worth KES 407,000. This is an annual return of about 15.08% compounded. For a refresher on the difference between simple and compound interest, watch this short video.

Unga Limited is a 111-year old business, making it one of the oldest businesses around. It started out as a milling company for human and animal feed, and has since diversified into grains under the brand Amana, and recently bought Ennsvalley Bakery. In 2018, there was an attempt by Seaboard, an American company to take over Unga Limited, but this was not successful. Seaboard, which has been a significant Unga shareholder since 2000 wanted to buy off 46.15% of Unga’s listed shares, and make the company private (i.e. delist it from the stock market), but this attempt failed, as minority shareholders declined to take Seaboard’s offer of KES 40 per share. Seaboard currently holds about 70% of Unga’s shares.

Back to the stock. The 15.08% per annum growth was split as follows:

- An increase in price, which delivered 11.83% of the return, and

- Unga’s dividend which delivered a 3.25% return per annum.

This means that most of Unga’s returns came from an increase in the price of the stock. The company paid little in dividends, which is understandable considering it was coming from a loss position and has invested in new business lines. Assuming you reinvested all the dividends you earned from the company, you doubled your money every 4.8 years approximately. This is impressive, considering that all you needed to do was:

a) Reinvest all the dividend earned

b) Do nothing else.

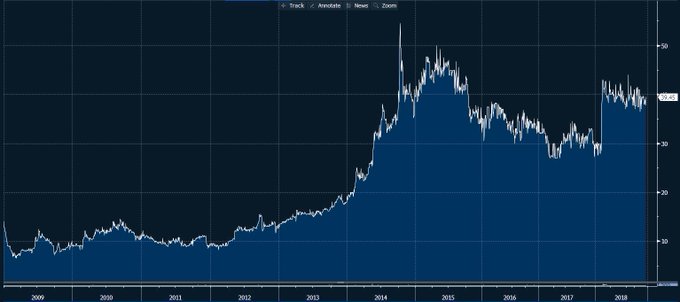

This sounds easy, but it is harder in practice. Looking at the stock chart below, stock had some dips in 2015, 2017 and 2018. It would have been tempting to sell then, which would have meant forgoing the gain that came thereafter. Growing your wealth through the stock market demands patience, and a good stomach for turbulence.

My thoughts on Unga Group: Unga is not a sexy stock. The company is not doing snazzy technology stuff or launching crazy growth plans, but it is in a critical business – the food business. If your view is similar to mine, that people will always eat, then this makes for an interesting stock to buy. Secondly, I do not think Seaboard has given up on delisting the company, they might make a future takeover attempt. Depending on the point at which they do, this might be a good opportunity to then exit the stock.

The major risks facing Unga, is competition from other millers, tight margins on food as the economy worsens, and shortage / high price of the raw materials they use such as soya and maize.

As I write this post, Unga is trading at KES 34.5 per share and its last dividend declaration of KES 0.5 per share.