Should You Buy Rental Houses Or A Government Bond?

Earlier this year, Peter Nduati, a homeowner and real estate investor sent this tweet that triggered a subsequent #52WeekChallenge chat.

https://twitter.com/PeterNduati/status/958763616324542465?s=19

I acknowledge this need to own real estate. It probably comes from a homing instinct that makes us feel more secure when we own some “soil”. Maybe because we feel that a house is a solid investment, unlike the other investments which are considered “paper investments”.

However, feelings aside, was Peter’s assertion true mathematically? Is it better to hold government instruments than rental real estate?

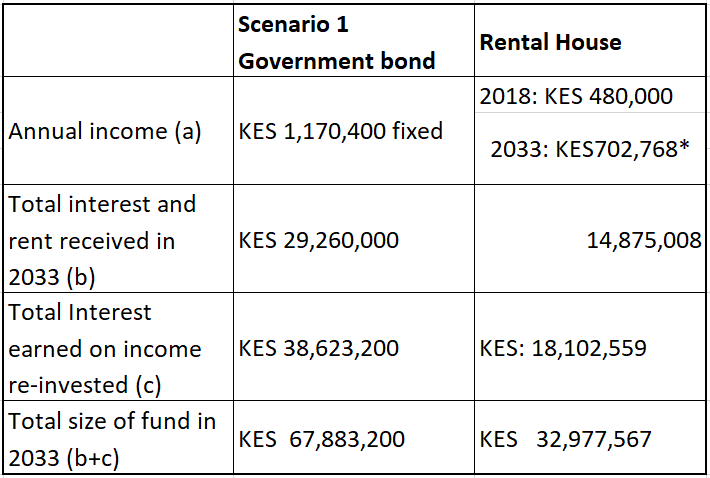

I decided to do some math based on two assumptions:

Government bond

The most recent long-term government bond issue which sold at a return rate 13.3% per annum. Its term is 25 years.

Real estate

This 2-bed apartment that is up for sale in Madaraka at KES 8.8 million. I picked this location because it has relatively high demand for housing hence high occupancy rate. The same website tells me that a similar apartment to rent goes for KES 40,000 per month.

I also assume that rental income grows by 10% every 5 years. This is based on the fact that most landlords are only able to renew rentals after the tenant leaves. For example, my current landlord has not renewed my rent for the three years I have lived in the house. If she did, I would look for another house, since cheaper houses are available.

Both are investments, and therefore I assume that the investor has KES 8.8 million to invest (if one was taking a mortgage, then the calculation is a bit different, because taking a long-term loan to buy a bond or to buy a rental house may not be a wise investment decision).

The final assumption is that both parties re-invest all the income received, at a uniform return rate of 11% per annum. This is a pre-tax calculation, assuming that in each case, the tax rate applied on earnings is the same.

*Rental income increases by 10% every year, from KES 40,000 in 2018.

At face value, it is quite obvious that investing in a government bond leaves you with a bigger fund in 2033. But then the rental house investor has a house at the end of the period, which is worth a lot more than it was worth in 2018.

How do we establish how much the house is worth? By applying an appreciation rate. The problem though is that in this case, the past may not predict history as accurately. We are moving from a time when Nairobi had an acute shortage of houses, to a period of a glut in middle and upper-income market. However, economic growth could spur an increase in demand. The only caution here is that trees do not grow to the sky – houses do not always double in value.

The only calculation I could do with some amount of certainty, is to ask, “by how much should your house appreciate for you to be at the same level as the government bond investor in 2033?” From my calculation, your house needs to appreciate by 5.65% every year from 2018 to 2033.

A few additional considerations:

- This calculation does not factor in the cost of repair and maintenance of the house. My understanding is that this can be up to KES 100,000 every couple of years. If I factor in a 25% cost of renovation, total interest in 25 years goes down by about KES 1 million and your required appreciation rate goes up to just under 6% per year.

- It does not factor land rent and rates which are standard for house owners.

- We assume that the rental house will be occupied 100% of the time, yet we know that normally, a house will be empty for 2-3 months in between tenants.

- To realise the appreciation of the house in 2033, the house owner will need to put it out into the market and find a willing buyer.

Why is the difference in income so stark?

This is because of the power of compound interest on income earned. Right from the start, the bond investor earns more than twice the rental income, and then they re-invest it. Also note that the rental house income never catches up (to do so, rental income would need to increase by 7.85% every year).

What if the government defaults on repayments?

This is a common response whenever such a comparison is made. Yes, the government can default (and a few governments have gone broke). But by the time a government goes broke enough to default on its obligations, all other investments in the economy have gone to the dogs, including real estate. Housing prices and also rentals would crash too. As such, when the government defaults, everyone who has investments in the country loses. Let that not stop you from investing though.

In my position, which one would I buy?

It depends. If I just want a place to pack cash and have no intention of selling, I would buy a house.

However, if I got the KES 8.8 million now when my focus is on growing my investment fund, then I will go with a government bond, then once I cash out, I would use the total fund to build a retirement home. Hopefully, the cost of building materials will decrease with time, or at least not increase too much.

2 Comments