Why Our Purchases Stop Making Us Happy After Some Time

How are your 2019 money goals so far? We are in Week 29 of the #52WeekChallenge take time to save some money this week.If you are yet to join, here is how to start the #52WeekChallenge today!

About 15 years ago while I was in university, my mother and I were talking about life after school, and my plans once I got a job. I remember clearly telling her that while I did not have many aspirations, I knew that I would buy as many pairs of shoes as I possibly could – I only had two pairs of shoes, one a hand-me-down, and a pair of open sandals. This was a long time ago, and now I have quite a number of pairs, and other things I need, and many other things that I do not need. I no longer think about shoes as a luxury, I do not own as many pairs as I once did.

This anecdote is reflective of many things in life. When we are not used to owning/consuming something, every time we consume it, it feels like luxury or a treat. Once we do it often enough, it becomes normal. It no longer contributes to our overall happiness. Think about things you regularly do – driving to work now versus when you first bought a car, drinking a latte, eating at your favourite restaurant, eating pizza for the third time this week etc.

This phenomenon is what psychologists call hedonic adaptation:

Hedonic adaptation, also known as “the hedonic treadmill,” refers to people’s general tendency to return to a set level of happiness despite life’s ups and downs. It is known as “the hedonic treadmill” because of the seeming cot “treading water” experience where we always end up where we started.

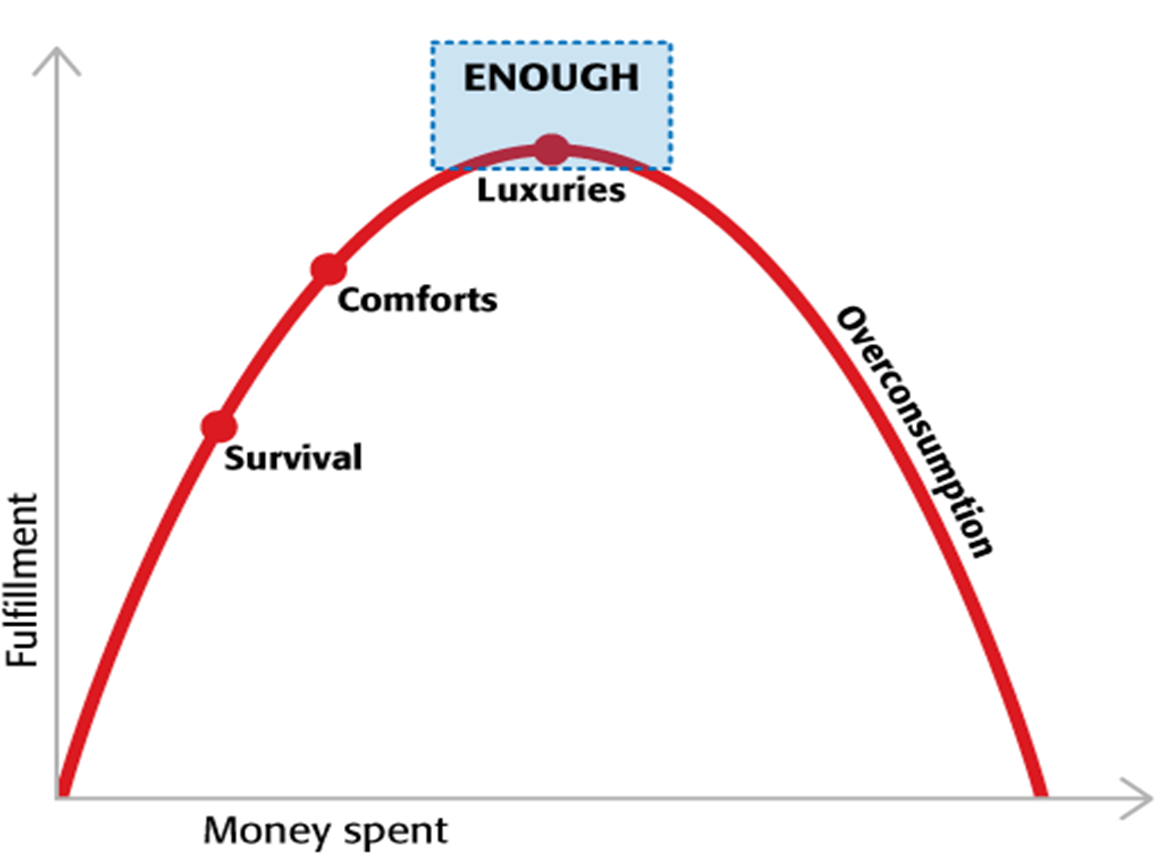

Up to a certain level, money does buy happiness – especially when we use it to eradicate practical complications e.g. getting a shorter commute, or reduce risks e.g. the security of having a great insurance covers, or when we buy experiences that make us happy, or finally when it gives us the freedom (buys us time) to do what we really enjoy.

However, when it comes to basic day to day consumption, the amount of money we spend makes very little difference to our happiness. This is especially so when it comes to consumption items such as the clothes we wear (beyond a certain function and aesthetic point), how premium the food we eat on a daily basis etc. I never believed the latter is true until I worked in a hotel, and was entitled to an item off the menu for lunch. For the first few months, I enjoyed eating all the nice yummy stuff then after a while I got used to the standard and it was routine – while the food was still as good, it really did not make a difference to the level of happiness I felt on a regular day.

The problem with hedonic adaptation when it comes to spending is that it is easy to get used to an unsustainable quality of life, where you work to sustain or keep upgrading your lifestyle, without much thought of how much happiness the spending is bringing you, or even the time trade-off you are making by choosing to do this. Think about our political leaders or even some middle and top management staff members who work to finance expensive lifestyles, from club memberships to expensive guzzlers, and homes in “addresses that matter”. I do not doubt that some of these expenses contribute to happiness, but I do wonder (especially for corporate workers), how sustainable and happiness-inducing 15-hour days are, just to keep up.

Think about areas in your life where you were perfectly fine buying cheaper stuff, but adjusted upwards because you now had more income, and make a deliberate effort to adjust back down. At first, it will feel terrible, same way adjusting upwards felt fantastic at first, but with time, your level of happiness readjusts and you end up at the same level as you were before the downward lifestyle adjustment.

Sometimes this may include getting rid of crutches that occupy our time, like the routine Thursday – Saturday evening drinks you catch with friends and do not think about much but spend a lot of money on. Make a deliberate effort to replace these expensive habits with cheaper ones that bring as much pleasure e.g. hosting your friends at home, learning new skills together, taking up hobbies that are cheap or free especially if they involve movement.

Finally, let the adjustment be a conscious one by your expenditure to see how much it is saving you and invest that money in avenues that shorten the number of years you have left to attaining financial freedom.