Our Kenya Airways Shares; Now We See Them, Now We Don’t! (Part II)

On rare occasions, I do speculate on the market. But as a rule, not with more than 20% of my portfolio. My speculation will be based on some expected market irrationality or a developing trend out of which I expect an unusual gain in the short-term (within a year), then I walk out of the position. Why I keep this at no more than 20% is you can never be clever at all with a speculative position. It can easily swing either way.

I subject my speculative positions to a second test: that if the outcome is not as I had anticipated, I should be prepared to hold my position for the longer-term without getting wiped out, but rather with some normal gains. My short term speculative positions anticipate anything north of 40% gain if it goes right.

Speculation is just that. I don’t pretend to base it on any fundamentals. Perceived market irrationality, yes. So when Michael Joseph was appointed and accepted to Chair the Board of KQ, I got my trigger. Any free cash that came in went to picking the share. I roped in Kellie who was a little hesitant. Talk of the restructuring was in the air and she warned of the massive dilution. I waved her away with The Name – Michael Joseph!! To her credit, she kept away as I did some biting. She however finally, still protesting, got in with a small hand. On my part, I wound up with some 40,000 shares picked at between Kes 5-6 just before the restructuring happened.

When trading in the shares was suspended for the restructuring, I made a mental note of the resumption of trading date. My hypothesis: the Michael Joseph magic plus less interest expense post debt conversion must mean good prospects for profitability and the market would pick that well in advance. At Kes 8 per share, I would have my 40% in and out I go to see how the fundamentals play out.

I never bothered reading any communication to shareholders. I didn’t pretend to want to know how much debt would be converted or at what rate. With losses, fundamentals are out the window, so why pretend to mind them?

The day before the resumption of trading, I called my brokers and asked them about the details of the deal. They didn’t appear confident about what it really entailed (Part 1 of this article covered this following my post-event curiosity that unearthed the details). I chose to wait for trading the following day. At the opening of the market, I called the dealer and he told me the market was in disarray. Prices had ranged from Kes 2 to more than 15! I had heard talk of splits and consolidation but no one seemed to know the ratios. So I asked the broker to check for me my CDS Holdings of the share. His answer hit me like a missile. My account had 10,000 shares! I had bought 40,000 over the previous three months. The price was stabilizing at around Kes 10 that morning. A quick calculation told me that with a net consolidation factor of 1 for 4, to be where I was at purchase, the share I bought for Kes 5 should have been trading at Kes 20. Here it was at 10! I was 50% shaved! – before commissions.

I made a quick decision. I impulsively decided to hedge my position. Since the price was erratic as no one seemed to quite grasp the import of the transaction, I gave the dealer an order for 10,000 more shares at Kes 8. My gamble was that if by some miracle the share rose to around 15 bob, my 20,000 total shares would be worth about 300k, my approximate cost price and I would exit and live to tell the story. I finally got my additional 10,000 shares at Kes 10 a piece.

Meanwhile, checking my email the following day, I found a sale order from Kellie to the brokers for her shares. She woke up to a KQ share price of 10 and given her initial misgivings, she didn’t wish to stay in a minute longer. Unbeknown to her, she had a quarter of her initial number of shares at about double the price, meaning half the value at which she had bought them. I quickly raised her and we were just in time to cancel the sale order with the brokers. I told her of my hedging gamble and she wisely countered, “I don’t know if I have the heart to hedge on KQ.” She had been hesitant on the buy in the first place and I had dragged her in!

So here is what happened to our shares in brief. Assume you had 10,000 shares bought at Kes 5 per share before the restructuring transaction. These shares would have cost you Kes 50,000 in total. After the restructuring, on the morning of the 29th November 2017 when trading resumed, you owned 2,500 shares, valued at say Kes 10 per share as that is where the price stabilized. This means that your holdings which had cost your Kes 50,000 was now worth Kes 25,000! Whether you had bought the share for speculative purposes as I had, or you were holding the shares from a deeper faith in KQ’s potential, that is what we both found ourselves sitting on when the dust had settled.

The share did in the short run consistently rally to a high of slightly above Kes 18 then fell, stabilized above Kes 15 for a while before falling all the way to below Kes 10 again. It is now trading between Kes 10 and 11. I have some faith in the restructuring exercise and I see the company back to profitability within the next two to three years. I cannot guess the level of that profitability but it is likely to finally drive the share beyond Kes 20, restoring those who will hold to their pre-restructuring position and maybe some gains. If that happens, the speculator may have lost on the short-term expectation but will make long-term gain.

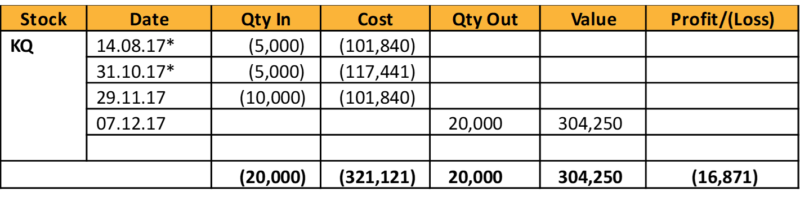

As for my hedging, I got greedy when I saw the price rising consistently. I decided to wait for 20 bob to sell my 20,000 shares and make a little profit. The share reached 18 and turned. You never get the highest point so I sold the following day at Kes 15.50. With the trading commissions factored in, I made a loss of only Kes16,871 on the transaction, thanks to the hedging. My trading account on the share looked as below:

I still intend to buy this share again when it falls below 10. It has been coming just short of that.

Because I have been mentioned several times in this post, it is imperative that I “defend myself”. This is me, Kellie :D. I agree with what Palmer says about speculation. One has to be careful, and know that it could go either way – so go in with capital preservation in mind, and know when to fold, like he did with the sale. As for Kenya Airways as a share, my opinion of it as a company has been pretty consistent, though I am one of its longsuffering shareholders that bought in when the company was soaring (literally). I have however been tentative on speculating on it, preferring instead to play with bank stocks, and even Safaricom.

1 Comment