Is M Pesa Contributing To Inflation?

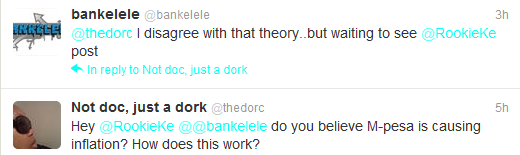

Yesterday, I saw a couple of tweets that implied that M Pesa has fueled inflation (See the article here), and my first instinct was to write this off as hogwash. Then, when @thedorc asked me this question, I was forced to think a little deeper:

In responding to @thedorc, I’ll try be use language that’s as simple as possible, without offending the hard core economists in the room, and I hope we can debate this theory in the comments section.

The argument fronted by the Business Daily article is derived from Milton Friedman’s quantity theory of money, which basically states that “Inflation is always, and everywhere a monetary phenomenon”. Friedman is credited for coming up with the equation of exchange:

M.V = P.Q Where:

M stands for total money in circulation in an economy over a period of time

V is the velocity of money; the speed at which money moves across the economy (see this article for a simplified explanation of V)

P is the price level or inflation

Q is the index of real expenditure on newly produced goods and services.

The above equation can be restated for V as follows:

V = P.Q / M.

This implies that the velocity of money is directly proportional to Price, and inversely proportional to the Quantity of Money. Let’s look at the Kenyan example now:

The argument fronted by the Business Daily article is that M Pesa has changed the velocity of money in our economy, to materially alter the country’s level of inflation.

In 2010, M Pesa moved approximately$8 billion, which was about 23% of our GDP. Using very literal and simplistic thinking, this money previously moved by the traditional means (Bank—–>ATM—–>Wallet——>Bus or other transport means——->End User etc). This $8 billion is moving faster than it takes for an Electronic Transfer to go through, once you hand over your form to the bank teller.

Is this material?

I think it is.

However, I think M Pesa has contributed to inflation and is not the sole cause of inflation. How should / would a government mitigate against this? I’m not an economist and I’d be going way over my head recommending solutions that are perfect, but let’s reverse the equation to work out P.

P=V.M/Q. If V is going up, Q is more or less constant, then the only reasonable thing to do is reduce M, to keep P constant, which is what Central Bank did, leading to increased interest rates, which then depresses Q going forward, so there has to be balance. It’s not an science, but any money transfer medium that significantly increases the velocity of money, then will definitely affect a country’s inflation rate.

@Bankelele please challenge my assumptions, let’s debate this.

1 Comment