Clarifying The Increase In Tax On SACCO Earnings And What You Can Do About It

A recent announcement in the media about doubling of withholding taxes on SACCO dividends has caused a frenzy on social media, and rightfully so. Kenya is the African country with the largest cooperative movement, and SACCOs continue to play an important role in our personal finance and investment journey. In addition to this, the annual SACCO dividend and bonus season is always a joyful time – when we see an actual return to our investments and savings in the SACCOs. This announcement however had some misinformation and therefore I consulted Ushuru.co.ke to help clarify what the real position is.

This post looks at how SACCOs are taxed, and the actual position on the withholding tax on SACCO dividends. It will focus on two types of SACCOs: SACCO societies (the ones we join to save and take loans from, and whose primary source of income is the interest we pay on those loans), and investment SACCOs, whose primary source of income is investments.

Background on SACCO taxation

For purposes of taxation, the primary SACCOs that individuals are allowed to join are classified into two, and each type is treated differently by the taxman:

- Primary SACCOs with investment income. These are what we call investment SACCOs. They are taxed at two levels: First, just like corporations, they pay an income tax of 30% on their net profits. However, unlike corporations, in computing the net profit, they are allowed to deduct any dividend or interest paid out to the members, though they are only allowed to pay out a maximum of 80% of their total income to members (this provision is meant to guard against tax evasion by paying out all income as dividends). This provision also means that the taxman is assured of taxable income every time members also get an income.

- SACCO societies, where we join to save and take loans. For these SACCOs, interest earned from loaning money to members is tax exempt. The SACCO may make other interest income (say from bank deposits). 50% of this income is subject to 30% income tax. The third level of taxation for SACCO societies is other incomes such as rents, dividends, capital gains and commissions which are subject to taxation under specified sources of income.

How SACCO earnings are taxed and the proposed increment

The second level of taxes is what the members pay. We call this tax, withholding tax. It is a tax that is deducted at source, meaning that you do not need to pay it yourself, the SACCO deducts it off your earnings before paying them to you.

SACCOs typically pay two types of earnings to their members:

a. Dividends, which are a percentage of your share capital in the SACCO. Share capital is what differentiates you as a member from other parties that may deposit money in the SACCO. Most SACCOs have a designated minimum share capital amount one must contribute when joining, and this forms the SACCO’s core capital. In many instances, share capital is not refundable when leaving the SACCO, and the only way to recover your share capital is to sell your shares to an existing or incoming member.

b. Interest. This is a return on your deposits on your SACCO. Your deposits are what you use to calculate your loan eligibility. Typically, deposits can be withdrawn at any time provided you do not have a loan, and should you need to leave the SACCO, you are entitled to your full deposit refund.

Previously, SACCO earnings (dividends and interest) were subject to a 5% withholding tax for residents and 10% for non-residents as a final tax.

There is now a proposal under the Income Tax Bill, 2018 to increase the withholding tax on SACCO earnings from the current 5% to 10% – double the current rate. It is important to note that this change has not yet been implemented. This year’s SACCO earnings will be taxed at 5%.

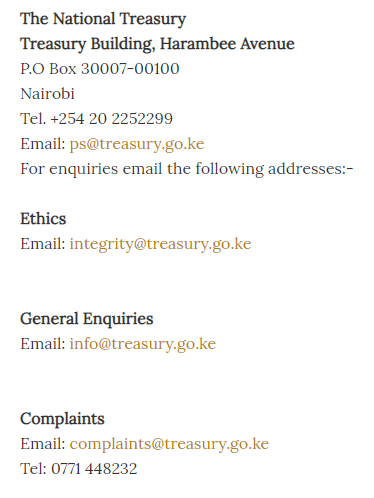

This tax increment has the adverse effect of discouraging saving, and it is our belief that it should not be passed by parliament. The issue has been opened up to public participation and you can write to the Treasury to protest its implementation.

Featured image credit: rawpixel

2 Comments