Preparing for the February 2017 Spending Diet

One of the key lessons from the January spending fast failures was that we were too ambitious to start out with a total fast. I now realise that a spending diet is a more sensible way to start off. A spending diet works the same way a food diet works. When doing a food diet, you set a goal you want to achieve (weight loss to x kgs, to cut out sugar etc), you evaluate your eating habits to see what you should reduce / cut out, then you track your eating habits. You do not stop eating completely!

The spending diet will work the same way, with slightly different implementation steps.

a)Create a list of your needs: These are items that you MUST spend a fixed amount of money on, to continue existing and functioning. This includes things like rent, utilities, savings etc. Note that I include savings in this, because paying ourselves is a need. Allocate the amounts you need to spend on this items.

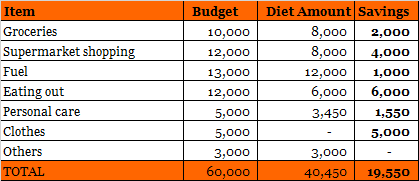

b) List the non essentials that you usually spend money on. This can include entertainment, eating out, clothes, shoes etc. Create a little table that looks something like the one I have below, where you input the amounts you currently spend, versus what you want to spend during the diet. Note that I included food shopping (groceries and supermarket), because while these are needs, there are things I could do to save a bit, without lowering the quality our lives. Bulk groceries shopping at the market is one, and not picking those chocolate bars at the check out queue in supermarkets is another 😀 . The #52WeekChallenge Telegram Group has been great for tips on how to save money daily.

My savings chart

When you set the savings goals, do not forget to put in place the systems and strategies you need for your diet to work. Same way we sign up for gym, get rid of junk food etc when going on a food diet. For each of my savings items above, here are my strategies:

- Groceries: Wanjiru from the #52WeekChallenge Telegram Group member shared her groceries shopping list from Wakulima Market, and for 2 weeks worth of groceries for a family of 4, she spends Kshs 1,900. I have adopted her list and her methods fully!

- Supermarket shopping: Usually, I shop in bulk from a wholesale shop, spending about Kshs 12,000 for 3 months worth of shopping. Then on a weekly basis, I buy milk, bread and other perishables from the supermarket. Ordinarily, this should not amount to even Kshs 1,000 per week, but I tend to pick other items that we do not need but want (you know how supermarkets are). I intend to limit my supermarket spend to a maximum 2,000 a week, since we have supplies to last us till end of March.

- Fuel: I will save Kshs 1,000 or more, if I manage my time better to avoid peak hours, because while the distance from my home to the office is 11km long, when I leave home late or the office during peak hours, I end up taking the bypass route (40km), which is faster but of course consumes more fuel than the 11km off peak. *crosses fingers*

- Eating out: I honestly have not figured this out yet! But a good start is a lunch I am having with a #52WeekChallenge friend, where we have agreed to split one Nairobi Restaurant Week meal, instead of ordering two meals. See us being frugal!

- Personal care: I still intend to trim my hair every weekend, the one thing that I will do is a home mani-pedi, instead of going to the salon. I do not polish my nails, so it is a little strange that I pay 1,500 bob to have someone scrub my hands and feet 😀

- Others: Everyone needs a little leeway to just spend. Just a little. Remember, budgets should not stifle the free spirit.

c) Set a timeline. For how long do you want to go on diet? Is it until you pay off a certain debt amount? Is it just for a month to see how much you will save? In my case, I would like to keep dieting throughout the year, but with different goals every month. For February, my goal is to save Kshs 20,000 towards debt repayments (I will explain why I am always repaying debts!). I still owe about 47,000 bob to our table bank that needs to be paid off before April. In March, I may set the diet amount lower to Kshs 10,000 to allow for a pair of heels and may be a new outfit. Even the strictest of diets allow for cheat days.

d) Save upfront by transferring your anticipated savings to a separate account. I will immediately transfer KShs 20,000 to a savings account, that way I will only have KShs 40,950 to spend once I pay off all my bills. You can use an MShwari account, or a savings account that is linked to your spending account. This leaves you with no room to overspend.

e) Leave your cards at home. Carry only one card with you – the card with your diet amount. This will reduce the temptation to overspend. Remember, personal finance is about training the mind and avoiding temptations!

f) Keep a list of your spend on non necessities. You can use an app to set your budget limits and to track your spending. This is important for future planning, but also so you know when to stop spending on a particular line item.

A spending diet is great for short term savings, to help you identify your spending triggers, and to help you adopt a whole new way of life. For me, 2017 is about two things:

- Increasing my income streams

- Accelerating my debt repayments

These spending fasts / diets/ challenges help me accomplish that, and to also remain conscious of my spending triggers and habits. What are your 2017 money goals? What have you done to make sure you meet these goals? Tweet me, write in the comments section or join our Telegram Group, let us discuss!

2 Comments